AS Level Economics 9708

5. Government macroeconomic intervention

Written by: Adhulan Rajkamal

Formatted by: Adhulan Rajkamal

Index

5.1 Government macroeconomic policy objectives

Price stability

- Low and stable inflation rate

- Government would not aim for 0% inflation because:

- Any measure of inflation tends to overstate rise in price level

- Might result in deflation

- A low and stable increase in price, caused by higher spending → encourages firms to increase output

- Many governments set inflation targets for their central banks to achieve (3%-6%)

- If firms, and households have confidence in the central bank’s ability to meet its target → they may act in a way that does not push prices up

- If workers think there will be price stability → they may not call for higher wages

Low unemployment

- Benefits of low unemployment:

- High output

- High tax revenue

- Low expenditure on unemployment benefits

- Government also aims to keep any unemployment experienced short term so that workers don’t lose their skills and work habits

- Done by promoting labor mobility through training schemes

- Government also concerned about the quality of employment

- High skilled, high paying and secure jobs

Economic growth

- Governments do not want excessive economic growth → Economy will overheat

- AD increasing faster than AS → Inflation

- Pressure on resources

- Entrepreneurs might become over-optimistic and set up unsustainable firms

- Households might take out large loans expecting their income to continue rising

- Good rate of economic growth is decided by government by keeping in mind certain factors:

- Size of the labor force

- Changes in productivity and advances in technology

5.2 Fiscal policy

- Use of taxation and government spending to influence AD in order to achieve its macroeconomic aims

🔥 Government budget

An annual statement in which the government outlines plans for its spending and tax revenue

- Government’s annual budget is a statement of its fiscal policy

| Budget surplus | Budget deficit | Balanced budget |

|---|---|---|

| Tax revenue exceeds government spending | Government spending exceeds tax revenue | Government spending matches tax revenue |

- Governments aim for a balanced budget in the long run

- In the short run they may aim for a deficit, especially when economic activity is low

National debt

- The total amount of government debt

- Usually represented as a % of GDP

- Budget deficit → Adds to national debt

- Budget surplus → May be used to repay national debt

- There is opportunity cost on the interest payments for national debt

Taxation

Indirect taxes

- Taxes on sale of goods and services

- Firms often pass tax to consumers via price increases (firms are legally required to pay the tax)

- Price Elasticity:

- Inelastic demand → higher proportion of tax passed to consumers.

- Types of Indirect Taxes

- Ad Valorem Taxes: Based on a percentage of product price. (Eg: VAT and GST)

- Specific Indirect Taxes: Fixed amount per unit of a product. (Eg: 2019 US petrol tax – $0.84/gallon + state taxes)

- Excise Duties/Sin Taxes: Target specific products (e.g., tobacco). To discourage unhealthy consumption.

Direct taxes

- Tax on income and wealth

- Eg: Income tax, corporate tax

Indirect VS Direct tax

- Recently government tend to rely more on indirect tax

- Greater reliance in indirect taxes → Income is less evenly distributed (indirect taxes → regressive)

- Advantages of indirect tax:

- Can be modified relatively quickly and easily

- Cheaper to collect (Firms do a part of the administrative work)

- Can also be used to discourage purchase of certain products

- Disadvantages of indirect tax:

- Cost push inflation

- Place an extra cost in suppliers

- People may try to avoid indirect taxes by smuggling

- Disadvantages of direct tax:

- Acts a disincentive to work → people may not work overtime or be reluctant to join labor force

- Disincentive to save → Income is taxed twice, once when earned and again when interest is received in savings

- Disincentive to innovation → Will not introduce new methods and products if they think their post-tax income will be too low

- High direct taxes may encourage tax avoidance (legal bending of rules for underpayment) and tax evasion (illegal non-payment or underpayment of tax)

Progressive, regressive and proportional taxes

- Progressive tax → One that takes a higher % of a person or firm’s income as income rises

- Regressive tax → One that takes a lower % of a person or firm’s income as income rises

- Proportional tax → Fixed % tax

Marginal and average rates of taxation

- Marginal rate of taxation (mrt) is the proportion of extra income taken in tax

- Average rate of taxation (art) is the proportion of a person’ total income taken in tax

- Progressive tax → mrt > art

- Regressive tax → mrt < art

- Proportional tax → mrt = art

Reasons for taxation

- To raise revenue to finance government spending on merit goods (like education and healthcare) and public goods (like defense)

- To influence AD

- A progressive income tax to redistribute income

- Discourage consumption of certain products (may be imports or demerit goods)

Government spending

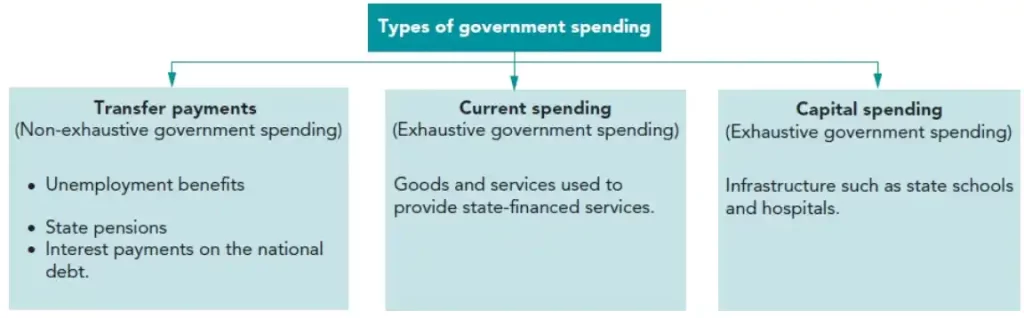

- Government spending divided into: spending on transfer payments, current spending and capital spending

- Current Spending: spending on goods/services for state-financed operations (Eg: wages of teachers, medicines for hospitals)

- Capital Spending: spending on long-term assets in the public sector (Eg: constructing schools, hospitals)

- Types of Spending:

- Exhaustive

- Consumes resources; impacts aggregate demand & GDP directly

- Includes current and capital spending

- Non-Exhaustive

- Transfer payments; recipients decide usage

- Does not consume resources directly

- Exhaustive

Reasons for government spending

- Linked to reasons for taxation

- To influence aggregate demand

- If private sector spending is too low, government will inject money through spending

- To increase AS → Spending on education, healthcare and infrastructure raises economies productive potential

- Also overcomes market failure

- Transfer payments → Reduces absolute poverty

- Political popularity – usually, spending increases before elections

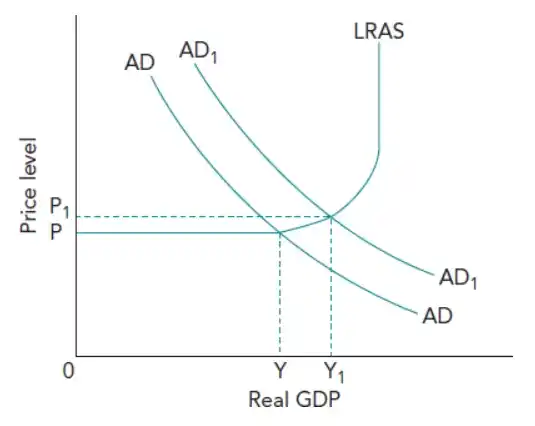

Expansionary and contractionary fiscal policy

- Expansionary fiscal policy

- To increase AD

- Cutting tax rates or the tax-base and/or increasing government spending

- Larger net-injection to the circular flow of income

- Contractionary fiscal policy

- To lower the growth of AD

- Reduce spending and/or increase taxes

The impact of fiscal policies

- Where a relatively small population pays income tax, reducing government spending may be more effective than increasing taxes [potential evaluation point]

- Raising income tax to reduce demand-pull inflation may not be effective → workers may demand higher wages to maintain disposable income levels, leading to cost push inflation (if demands are granted) [potential evaluation point]

- Increased taxes → Disincentive to work

- Workers may emigrate to countries with lesser tax or leave the labor force

- Will reduce productive capacity and AS

- Expansionary fiscal policy may not work if households and firms are worried about the future → additional disposable income will be saved [potential evaluation point]

- There is the risk of the government injecting too much money leading to demand-pull inflation [potential evaluation point]

- The impact of fiscal policies may take a long time to transmit full effect to the macroeconomy:

- Infrastructure spending (1-3 years)

- Tax reforms (6 months to 2 years) – reforms require legislative approval and households and firms to adjust their behavior

- Healthcare investments (5-15 years)

5.3 Monetary policy

- The use of interest rates, the money supply, credit regulations and the exchange rate to influence aggregate demand

- Interest rates: Essentially price of money

- Money supply:

- Changes in qty. of money in the economy influences AD

- Central bank may electronically print money (by adding funds to the central bank’s own accounts or the accounts of the commercial banks)

- Control lending by commercial banks (Lending by commercial banks → main factor influencing money supply)

- Exchange rate: Central banks may manipulate exchange rate to influence AD

- By buying and selling own currency in forex market

- Adjusting interest rates attracts or discourages foreigners from saving (in savings accounts) or investing locally, such as in government bonds, thereby influencing demand for the local currency.

🔥 Investment locally

An increase in interest rates leads to a decrease in local investments, as borrowing becomes more expensive, while local savings rise due to higher returns on deposits

- Quantitative Easing (EQ) or Tightening → Increase or decrease money supply which will influence exchange rate

- Credit regulations:

- Used to influence bank lending

- Most central banks require commercial banks to hold a proportion of their assets in a highly liquid form (Cash Reserve Ratio – CRR)

Expansionary and contractionary monetary policy

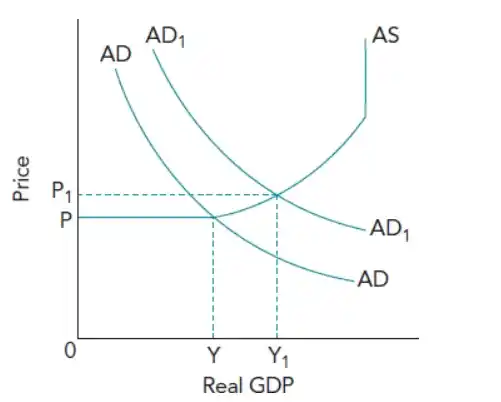

- Expansionary monetary policy → Increase AD

- Interest rates ↓

- Money supply ↑

- Reduction in restriction in bank lending (reduced CRR)

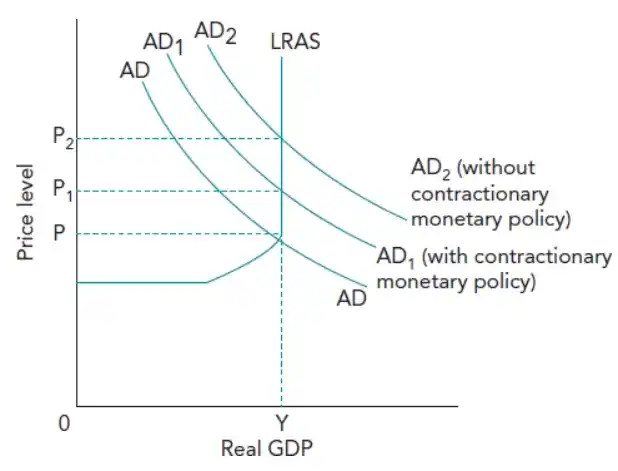

- Contractionary monetary policy → Reduce AD

- Interest rates ↑

- Money supply ↓

- Restrictions on bank lending

Impact of monetary policy

- In many countries, the main policy used to reduce demand-pull inflation → monetary policy (especially interest rates)

- If increase in money supply = increase in output there will be no upward movement in price level (lower growth of money supply → curb inflation)

- Commercial banks usually keep their interest rate in line with the central bank as it is the rate they will have to pay if they need to borrow from the central bank

- However, there is no guarantee that commercial banks increase interest rates when the central bank increases their interest rate (might have to be enforced)

- Consumers may not reduce their spending if they are optimistic of their future income

- Rise in interest rate → investment falls

- Higher interest rates increase returns on savings or low-risk financial instruments (e.g., bonds). Using profits for business investment means giving up these higher guaranteed returns → greater opportunity cost

- Higher interest rates make debt repayment more expensive. Profits used for investment cannot reduce costly debt, increasing financial burden → greater opportunity cost

- Higher opportunity costs discourage businesses from reinvesting profits into new projects or capital, reducing overall investment.

- If investment falls below depreciation → capital stock will decline

- AS will fall and push up price levels

- Expansionary monetary policy during deflation might not help → Consumers may be pessimistic and delay spending

- Central banks may increase money supply, increasing the funds commercial banks have → but commercial banks may be reluctant to lend if there are no creditworthy borrowers

Equilibrium national income, the real level of output and employment

- If there is spare capacity, expansionary monetary policy will result in higher national income

- Higher output → Increased employment

- Contractionary monetary policy may reduce national income, output, and employment, but when applied in an economy with all resources employed, it can help lower inflation

The effectiveness of monetary policy

- Practically, difficult to control money supply

- Commercial bank have strong incentive to increase lending, and may work around any limits placed by central banks

- Controlling certain forms of money may lead to new forms of money being used

- There is a time lag b/w changing interest rates and the full effect being transmitted to the macroeconomy (estimated time 18 months)

- Increasing financial mobility makes it difficult for a country to maintain interest rates significantly different from other nations, as it impacts exchange rates

5.4 Supply-side policy

- Government policy tools designed to increase AS

- They seek to increase productive capacity → shift LRAS to right

- Education and training

- Improves workers’ skills and productivity

- Improves flexibility and mobility

- Will also increase quality of enterprise → increases innovation

- Promoting infrastructure development

- Efficient transport, power, energy and telecommunication networks keeps cost of production low (encourages firms and MNCs), and improves productivity

- Support for technological improvement

- Increase productivity of capital

- Can subsidise universities and private firms to encourage R&D

- Other tools

- Cuts in corporate tax → Encourages investment (increases both AD and AS)

- Cuts in income tax → Encourages workers to increase working hours, accept promotion, remain in the labour force for longer or enter the labour force (increases AS and AD)

- Trade union reform → Increase workers flexibility and mobility and cut down the number of days lost through strikes. Reduction in industrial action will encourage firms and MNCs to set up.

- Privatisation and deregulation → Private-sector firms likely to operate more efficiently. Deregulation reduces barriers of entry and cost of production.

- Encouragement of immigration → Immigration of skilled labour increases both quantity and quality of labour

🔥 Tip

Do determine whether a change in tax or government spending is a fiscal or supply-side policy tool, think about the government’s objective. If the government is trying to influence AD → Fiscal policy tool; if the government is trying to influence AS → Supply-side policy tool.

Impact of supply-side policy tools on macroeconomy

- Potential to benefit all of the government’s policy objectives in the long run

- Increasing productivity of labour and capital resources → can increase national income and real output

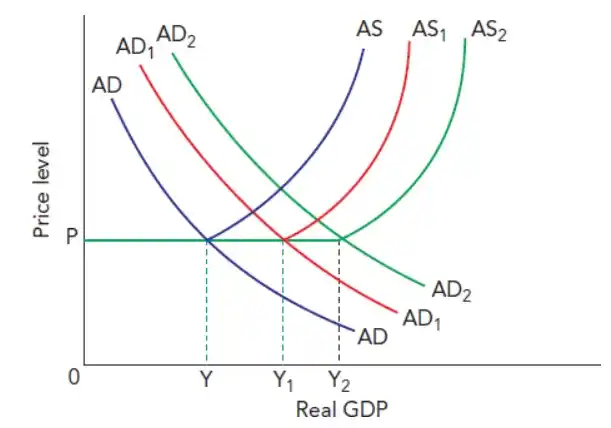

- Over time AD increases; if AS keeps pace with AD, a country can enjoy greater output without demand-pull inflation

- Can also be used to counter cost-push inflation → Spending on labour training will increase labour productivity and so reduce labour costs

- Labour training will improve skills and therefore geographical and occupational mobility → Reduce frictional and structural unemployment

- Investment in capital R&D might cause technological unemployment. However since improvements in technology reduces cost of production and therefore increases sales, more workers may be employed to produce more

Effectiveness of supply-side policies

- Spending on education and healthcare is not effective in the short run. Can also contribute to inflation in the short run since it will increase AD before increasing AS

- If rise in worker productivity is lesser than rise in wage then cost of production will rise

- Skills that will be in demand in the long-term must be taught. Not effective is training is not of high quality

- Infrastructure developments take time and might be harmful for the environment. Demand for the infrastructure might have also changed by the time of completion

- If economy is already operating spare capacity, supply side policy will increase productive capacity but not production because there is not sufficient AD