AS Level Economics 9708

6. International economic issues

Written by: Adhulan Rajkamal

Formatted by: Adhulan Rajkamal

Index

6.1 The reasons for international trade

- Different countries have difference factor endowments → affects the types, quality and quantity of products produced – also affects cost of production

- Factor endowments → The availability and quality of capital, enterprise, land and labour

Absolute advantage

- Definition: The ability of a country to produce more of a good using the same amount of resources

- Focus: Productivity (who can produce the most)

- Example: If Country A can produce 10 cars and Country B can produce 6 cars with the same resources, Country A has an absolute advantage in car production

Comparative advantage

- Definition: The ability of a country to produce a good at a lower opportunity cost than another.

- Focus: Opportunity Cost (what is given up to produce a good)

🔥 Calculating opportunity cost

$$\text{Opportunity cost of 1 Good X} = \frac{\text{loss of Good Y}}{\text{gain of Good X}}$$

This value tells us how much of Y has to be given up to produce 1 unit of X

- Key Idea: Countries should specialize in the good where they have a comparative advantage and trade for the other.

- Eg: Opportunity costs:

- Country A: 1 car = 2 computers.

- Country B: 1 car = 0.5 computers.

- Country B has a comparative advantage in cars because it gives up fewer computers (0.5 < 2)

- Trade Principle: Specialize in the good with comparative advantage → Mutual Gains through trade and efficient resource allocation

- Increased world output and employment

- Raises standard of living globally

🔥 Steps to determine mutual benefit

- Step 1: Calculate opportunity cost for both countries

- Step 2: Identify the exchange rate

- Step 3: Compare the exchange rate with opportunity costs

- Trade is beneficial if the exchange rate lies between their opportunity costs

Benefits of specialisation and free trade (trade liberalisation)

- Free trade → Exchange of goods and services across national borders without any government restrictions

- Free trade allows countries to specialize based on comparative advantage

- Competition from free trade → pressure for firms to keep prices low, improve quality, and be highly efficient

- Firms will be able to buy capital goods and raw materials at lower costs (competition in those markets too)

- Firms can produce larger output when they have access to international markets → economies of scale

- Consumers will have greater variety of goods and services to choose from; firms have a wider source of raw materials and capital goods

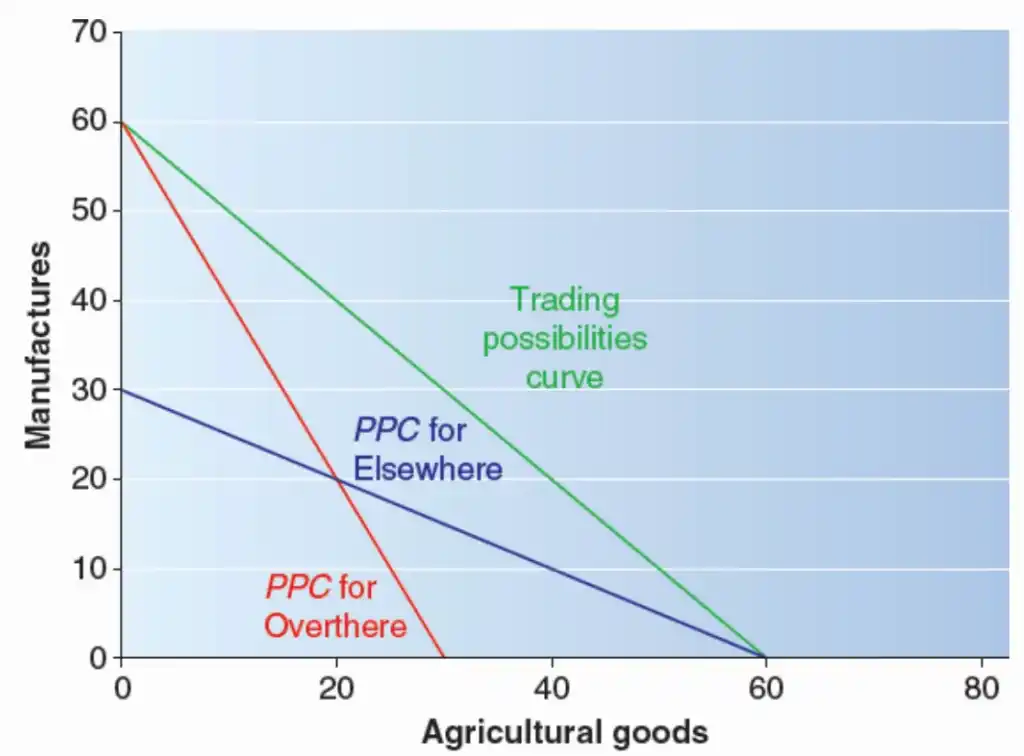

Trading possibility curve

- Definition → A diagram that shows the combination of two goods a country can consume after engaging in international trade, which lies beyond its PPC

- Note: Trading possibility curve illustrates that while a country cannot produce outside its PPC, international trade can allow it to consume outside its PPC

Note: Elsewhere and Overthere are countries

Terms of trade

Measurements of the terms of trade

Terms of trade → Measure of the ratio of export and import prices

🔥 Calculating terms of trade index

$$\text{Terms of trade index} = \frac{\text{index of export prices}}{\text{index of import prices}} \times 100$$

- Ratio calculated from the average prices of many goods and services that are traded internationally

- The prices are weighted based on their relative importance

- Terms of trade index increases → favourable movement/ improvement; fewer exports have to be sold to buy any given quantity of imports

- Terms of trade index decreases → unfavourable movement/ deterioration

Causes of changes in the terms of trade

- Favourable change → rise in exports prices relative to import prices

- Causes of changes in price → demand for and supply of exports and imports

- Increase in demand for exports (and/or) rise in relative inflation → rise in prices of exports → favourable change in terms of trade

- Devaluing a currency → deliberate deterioration of terms of trade to make exports more internationally competitive

Impact of changes in terms of trade

- Though rise in terms of trade → favourable movement; the impacts of a favourable movement may not always be beneficial

- Effect of the movement will depend on its cause

- Due to rise in demand → beneficial as more products will be sold

- Due to higher relative inflation → lesser products will be sold (less competitive in the international market)

- Unfavourable movement in terms of trade → may reduce current account deficit

- If demand for exports and imports are elastic, a relative fall in export prices will result in relative increase in export revenue to import expenditure

- Note: Terms of trade is a measure of import and export price – do not confuse with balance of trade

Limitations of the theory of absolute and comparative advantage

- They do not provide the full explanation for the pattern of international trade

- Some governments want to avoid overspecialisation

- High transport cost may offset the comparative advantage

- The exchange rate may not lie between the opportunity cost ratios

- Governments may impose trade restrictions

- Theory of comparative advantage also assume that resources are mobile

- Countries do not adapt to changes in comparative advantage

- Difficult to determine where a country’s comparative advantage lies

6.2 Protectionism

- Definition → Protecting domestic producers from foreign competition. It involves the restriction of free trade

Tools of protection

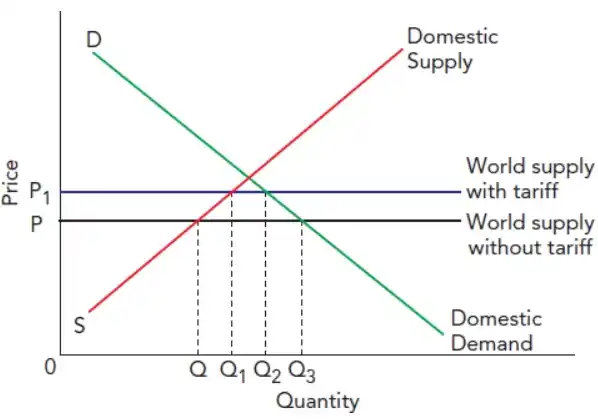

Tariffs

- Tariffs (custom duties) → Taxes usually in imports; sometimes on exports

- Decreases consumption of the good, but increases domestic production

- Can be: specific → fixed sum per unit (or) ad valorem → % if the price

- Import tariffs used to discourage imports and raise tax revenue

- Video to understand the graph → Protectionism

🔥 Evaluation points

- Tariff will be more effective in raising revenue if demand for imports is price inelastic however it will be more effective in protecting domestic industry if PED of imports is elastic

- A tariff may not boost domestic price competitiveness if it remains below domestic prices or if importers absorb the tariff without raising prices

- Export tariffs

- May be imposed to raise revenue – if demand for export is inelastic, low effect on demand

- To ensure adequate supply of the product in domestic market

- Also acts as a form of protectionism if imposed on export of raw materials (raw materials are cheaper for local producers than international producer)

Import quotas

- Limit on imports

- Restricting the supply of imports → drive up prices

- Disadvantages consumer

- Sellers will receive the extra price

- Do not raise revenue for government (usually) – however, government may sell licenses to firms for an allocation of the quota

- Export quotas may also be imposed

Export subsidies

- Subsidies given to both exporters and domestic firms that compete with imports

- The losers will be foreign firms and domestic taxpayers

- Domestic producers will gain

- In the long run, more efficient firms may be driven out of business and subsidised firms will raise their prices

Other tools

- Embargoes → Complete ban on the import of a particular good or on trade with a particular country

- Voluntary export restraints → A limit placed on the imports reached with agreement of the supplying country

- Red tape (Excessive administrative burdens) → Force importers to fill out long and lengthy forms; or set artificially high quality standards

- Exchange control → Restrictions on the purchase of foreign currency

- Instead of limiting imports directly, the amount of foreign exchange that can be purchased is limited

The arguments for protectionism

- To protect infant (sunrise) industries

- Trade restrictions may help new industries grow, achieve efficiency (economies of scale) and comparative advantage, but it’s hard to predict their success or cost structures

- Risks: Industries may become reliant on protection, reducing incentives to lower costs as foreign competition is artificially limited

- To protect sunset industries

- If industries that have lost their comparative advantage go out of business quickly → sudden and large rise in unemployment

- Protection given and gradually removed – large rise in unemployment avoided

- Risk: Sunset industry may resist gradual reduction in protection. Can create inefficiency and harm other industries, e.g., tariffs to help steel industry raise car production costs

🔥 Examples (India)

- Sunrise industries of India → Renewable energy, Electrical Vehicle (EV)

- Sunset industries of India → Textiles and jute (excessive international competition from Bangladesh, China, and Vietnam), coal mining (transition towards renewables)

- To protect strategic industries (Eg: Food, weapons, fuel, etc.)

- To prevent dumping

- Selling products in a foreign market at below their cost of production

- In the short run – home consumers will benefit from dumping

- In the long run – foreign firms gain a monopoly, and may raise prices

- To improve terms of trade

- If the home country is a major source of demand → imposing trade restrictions → reduces demand significantly → forcing prices down → favourable movement in terms of trade

- If home country is a major supplier → imposing export restrictions → prices rise → increases the purchasing power of exports

- However, such actions distort trade, reduce global output, and may provoke retaliation

- To improve balance of payments

- Trade restrictions only provide a short-term boost to the current account

- To provide protection from cheap labour

Arguments against protectionism

- Lowers global output and therefore living standards

- Reduced international competition → higher prices and reduced quality

- Reduced choice of products for consumers

- Lower market sizes for firms → cannot take advantage of economies of scale

- Reduce firms’ choice of raw materials and capital goods → may increase cost of production

6.3 Current account of the balance of payments

- Balance of payments → Record of all economic transactions between the residents of that country and residents in other countries

- Balance of payments account consists of → Current account, capital account, and the financial account

- Money coming into the country → credit item → +ve sign

- Money going out → debit item → -ve sign

Components of the current account of the balance of payments

- Trade in goods: refers to the exports and imports (exports → credit item; imports → debit item)

- Trade in services: Refers to the exports and imports of services (also known as invisibles); Eg: shipping, tourism, banking and insurance

- Primary income: Includes income from profits, interest and dividends earned on direct investment abroad (credit item) and foreign earnings from investment in the home country (debit item)

- Also includes employees’ compensation → wages earned by the home country’s residents temporarily working in other countries

- Secondary income: Includes payments and receipts for which there is no corresponding exchange of an actual good or service. It includes:

- Financial aid given or received

- Remittances (money sent back by individuals working in a foreign country permanently – more than a year – to their relatives in the home country)

Imbalance in the current account

- Imbalance → debit items is not equal credit items

- Credit items (receipts) > debit items (payments) → Current account surplus (+ve balance)

- Debit items > credit items → Current account deficit (-ve balance)

🔥Fun fact

The sum of the current account balances of all countries will be equal to 0!

Current account balance calculation

- Find the balance of trade in goods: Exports = $900m, Imports = $1200m → –$300m (deficit)

- Find the balance of trade in services: Exports = $160m, Imports = $100m → +$60m (surplus).

- Calculate the balance of trade in goods and services:

Add the balance of trade in goods and the balance of trade in services

–$300m + $60m = –$240m. - Calculate the current account balance:

Balance of primary income = +$70m

Balance of secondary income = +$45m

Combine the total trade balance, primary income, and secondary income

–$240m + $70m + $45m = –$125m

Causes of imbalances in the current account

- A growing domestic economy: Demand for raw materials and capital equipment from abroad is high; output may be directed to the domestic market rather than the international market

- This current account deficit is only in the short-run

- Self-correcting

- Declining economic activity in a country’s trading partners: The import expenditure of foreign countries will reduce

- Deficits occurring due to changes in economic cycles of foreign or domestic economy → cyclical deficit

- Short-term

- Structural problems: Deficit lasting in the long run – dangerous

- Indicates that domestic firms are not internationally competitive

- Overvalued exchange rate

- High relative inflation rate

- Low labour and capital productivity

- Not self correcting

- Indicates that domestic firms are not internationally competitive

- Note: Consider the opposites for current account surplus

Consequences of imbalances in the current account

- Current account deficit allows residents to consume more value of products than the country produces → this deficit has to be financed by borrowing or by attracting investment

- Increased current account deficit → fall in AD → reduced economic growth and increased unemployment

- Current account surplus means residents are not enjoying as high a living standard as possible

- Increased AD and money supply → inflationary pressure

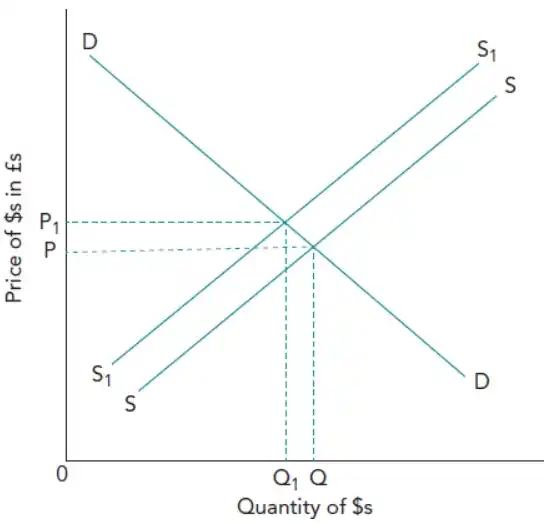

6.4 Exchange rates

- Exchange rate → the price of one country in terms of another currency

- Floating exchange rate → Exchange rate that is determined by the market forces of demand and supply

- Currencies are bought and sold in the foreign exchange market → made up of financial institutions that buy and sell foreign currency on behalf of private and business customers

- Reasons why currency traders buy domestic currency (opposite for sell):

- Purchase goods and services from the country

- Invest in the country

- Speculate on making a profit if the value of the currency should rise in the future

- Depreciation → Fall in the international price of a currency caused by market forces

- Note: Use demand-supply diagrams to show appreciation and depreciation

Causes of changes in a floating exchange rate

- Changes in demand and supply of a currency

- Demand increases if:

- High value of exports

- Improvement in country’s economic prospects → foreign investments in assets (eg: shares)

- Relatively high interest rates → foreigner would want to save in domestic banks (this short-term movement of money → hot money flows)

- Speculation about future interest rate and exchange rate

- Note: Higher demand for one currency is simultaneous with higher supply of another

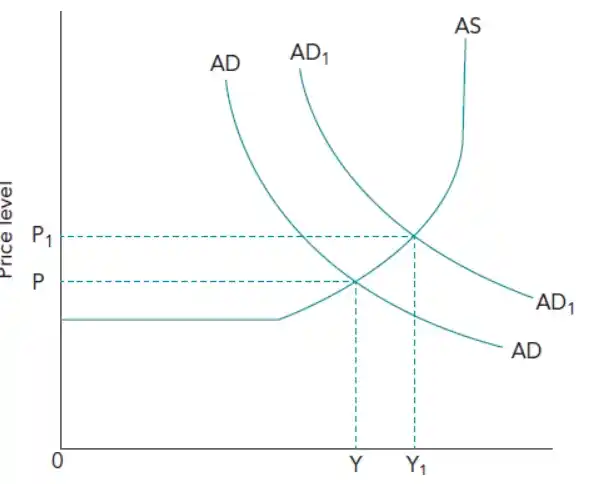

Impact of exchange rate changes on the domestic economy

Depreciation

- Exports cheaper and imports more expensive → domestic firms can sell more at home and abroad → increased output → increased employment

- Rise in net exports → increases AD → may result in a rise in national income

- Higher AD → inflationary pressure

- Finished imported products that are still purchased → will count in the CPI

- Cost of production increases price of imported raw materials rise

- Opposite for appreciation

- It will cause a fall in inflationary pressure (rate of inflation decreases) since AD decreases

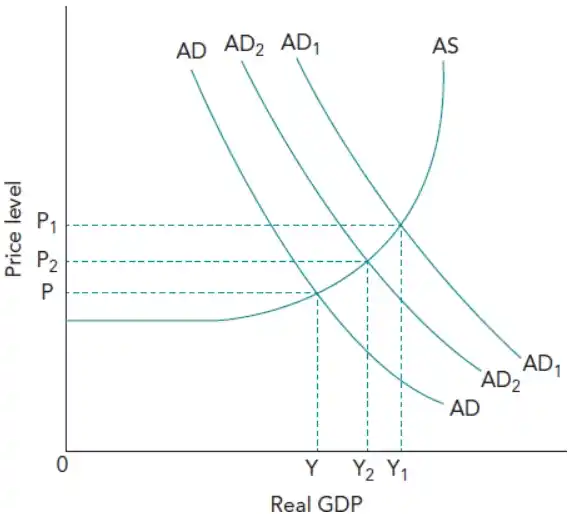

Instead of AD1 the AD rises to AD2 due to appreciation leading to a fall in net exports

- Inflationary pressure also reduces to a right-ward shift in supply → imported raw materials become cheaper hence lower cost of production

6.5 Policies to correct imbalances in the current account

- Governments seek balance of payments stability → money entering = money leaving

- If export revenue = import expenditure → no international debt and good standard of living

- In the short-run, deficit arising from high imports of raw materials and capital goods is healthy

- Government may seek a surplus to pay off external debt

- To judge the extent of imbalance → view surplus/ deficit as a % of GDP

Effect of fiscal policy

- To correct deficit arising from excessive imports → contractionary fiscal policy

- Lowers domestic and import demand → firms are pressured to increase exports to sell stock

- Fiscal policy measures → short-term solutions

- Once policy measures are stopped → back to old spending patterns

- Also have adverse side effects

Effect of monetary policy

- Monetary policy to correct current account: Complex approach

- Low inflation + current account deficit: Central bank may lower interest rates → Depreciates exchange rate → Boosts export competitiveness

- Higher interest rates: Reduces consumer spending → Lowers import demand but may appreciate exchange rate, offsetting import reduction

- Long-term ineffectiveness: Fails to address structural weaknesses (e.g., low productivity)

- No impact on strengths: High innovation or ownership of scarce resources remains unaffected

Effect of supply side policy

- May reduce deficit → domestic products more price competitive; domestic markets more attractive to invest in

- Spending on education and subsidies→ more skilled labour force and better capital equipment → reduces relative price of domestic output and increases quality → increased exports

- Trade union reform → Increases flexibility for domestic firms, improving responsiveness to demand changes; more appealing to MNCs

- Long-term potential to reduce deficits but may not address short-term imbalances or surpluses effectively

Effect of protectionist policy

- There must be close substitutes to imported goods produced locally

- Tariffs against trading partners in a trade bloc → not possible

- Imposing tariffs has 2 risks:

- Provoke retaliation

- Reduces pressure on domestic firms to become more efficient